Summary

The Alchemist Council is proposing to change MIST tokenomics through the implementation of the following measures:

-

A new rewards program for single-sided MIST stakers called “Community Harvest Alchemist Distribution (CHAD)” aka “CHAD Stakers Rewards”.

-

Rename the current “Aludel Rewards Program for MIST-WETH LPs” to “CHAD LPs Rewards”.

-

Configure the CHAD Rewards for Stakers and LPs to be driven solely by product revenues in the native tokens those revenues were earned. Historically that would include USDC, ETH, WETH.

-

A new opt-in long-term ALCHECHAD rewards program that achieves the goals of vesting MIST, where LPs and MIST stakers can commit to staking their LP or MIST for 12 months in exchange for each program individually receiving 2.5% of the MIST inflation.

-

Redirecting the 50% of MIST inflation currently received by MIST-WETH LPs to instead go towards funding the Alchemist incubator and new products.

We believe these are important tokenomics changes necessary for reinvigorating the Alchemist ecosystem and look forward to hearing the community’s feedback on them.

Read on to take a deep dive into why we believe these changes to the current tokenomics of MIST could be the catalyst Alchemist needs to continue growing and what our future could look like.

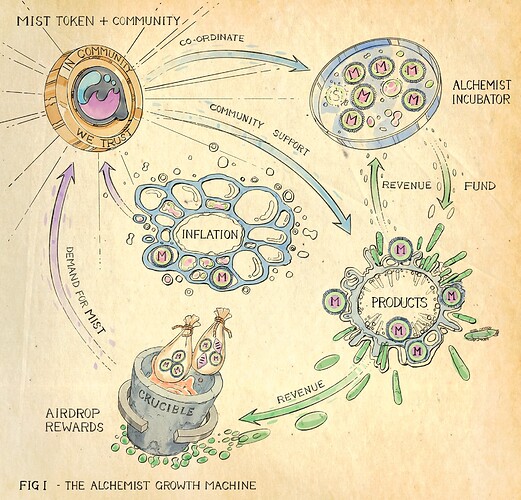

The Alchemist Growth Machine (GM

)

)

Alchemist is a cycle, in which MIST inflation is used to create new products, those products contribute value back to MIST, then based on that value future MIST inflation gains the strength to fund even more products, and the cycle repeats again. This cycle has the potential to facilitate perpetual growth if utilised effectively by the Alchemist community. Therefore, our duty as a community is to continuously fine tune and iterate on our processes to operate this growth machine to ensure that it operates smoothly.

Inflation ➝ MIST + Community Coordination ➝ Products ➝ Airdrops ➝ MIST Demand ➝ Stronger Inflation

MIST’s initial value was bootstrapped by four innovative products: MIST token inflation (the fuel for a self-perpetuating growth machine), the Crucible and the MIST-WETH LP rewards program (the first product delivered by Alchemist builders which also served as the foundation for our tokenomics), “the only plan is there is no plan” (the narrative of having no narrative), and a fair launch of MIST conducted through an LBP (the origins that incentivized a new community to become active contributors and builders within Alchemist). These initial products resulted in significant value accrual to MIST that then ensured that future MIST inflation cycles had the power to fund the development of new products. The Alchemist Growth Machine was set in motion.

A product is typically described as an article or substance that is manufactured or refined for sale. In the context of Alchemist, everything that has the potential to accrue value to MIST is a product. Tokenomics, builders, narrative, and community – these are all product areas with huge potential to impact the value of MIST.

Since inception, the largest innovations at Alchemist have occured at the builder and community levels – a test of nature’s rules, from chaos emerged order. Groups of strangers formed teams to build and experiment with multiple innovative products: the Crucible, the Alchemist Seniors, mistX, Copper, sandwiched.wtf, Alchemist Radio, Chaos Lab, the Alchemist Council, the Alchemist Incubator, to name a few. Some of these products were more successful than others, but lessons about product design, team building, community, business, and governance were learned from all. Specifically, how to create value from nothingness and uncertainty. The knowledge gained during this time will continue to live within Alchemist and benefit all of our products moving forward. The Growth Machine continues.

Over the course of the last year, the product within Alchemist that has suffered the most from a lack of innovation has been MIST tokenomics. At the heart of MIST tokenomics we have an incredibly powerful tool: inflation. However, beyond that our tokenomics has grown stagnant and poses a very real threat of “Death by ossification”, to quote the Alchemist alien. With MIST at all time lows the potential of the Alchemist Incubator as a builder’s Growth Machine and the corresponding narrative is severely limited.

Through this proposal to our community, we hope to evolve our tokenomics by restructuring our rewards program to drive value back to MIST.

Tokenomics Strategic Challenges

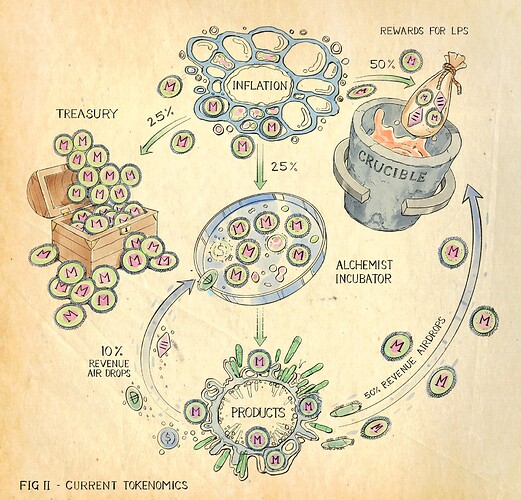

Below is a diagram illustrating our current tokenomics.

There are numerous problems with our existing tokenomics setup:

-

The only group of stakeholders that the current Aludel Rewards Program favours are MIST-WETH LPs, and it does not represent the free-floating MIST in circulation. Free-floating MIST (defined as MIST not locked up in LP, the Crucible rewards pool, the treasury, the multisig, or vesting contracts) makes up about ~50% of all MIST and is composed of 11K token holders.

-

For LPs, the rewards program weighs heavily towards early LPs and somewhat discourages new LPs from entering the rewards program.

-

The 25% of MIST inflation currently received by the Alchemist Incubator funds core community operations as well as newly incubated projects. The current price of MIST is too low to result in a significant wave of new incubations.

-

Alchemist community engagement is at an all time low and governance tends to favour LP providers.

-

Directing MIST inflation to the Aludel Rewards Program is zero sum for the Alchemist community because it attempts to consume MIST without first running it through the Growth Machine and creating new product value using that MIST. The Alchemist Growth Machine isn’t functioning effectively because its fuel, inflation, is leaking rather than going straight to the engine that drives everything.

Alchemist is a Growth Machine fueled by inflation and supported by the MIST community. To reinforce and strengthen this narrative, MIST inflation should be used to solely fuel the incubator, while reward pools should benefit from value accrued to MIST as a result of the incubator increasing the value of the whole Alchemist ecosystem.

Desired Outcomes of Tokenomics Changes

Alchemist tokenomics need to be consistent with our core mission of driving value back to MIST through the Growth Machine. Reinforcing this cycle will reignite and solidify our mission. The new tokenomics system must:

-

Engage our whole community of token holders and not just liquidity providers; foster tighter bonds and cooperation within the community.

-

Give the Alchemist incubator the proper resources to incubate more teams.

-

Strengthen the reflexive relationship between token holders and Alchemist products.

-

Focus on the core Alchemist principle of creating products via inflation, with the goal of increasing the overall value of the Alchemist ecosystem by ensuring that newly created products add enough value to outpace inflation.

Next Generation Tokenomics Details

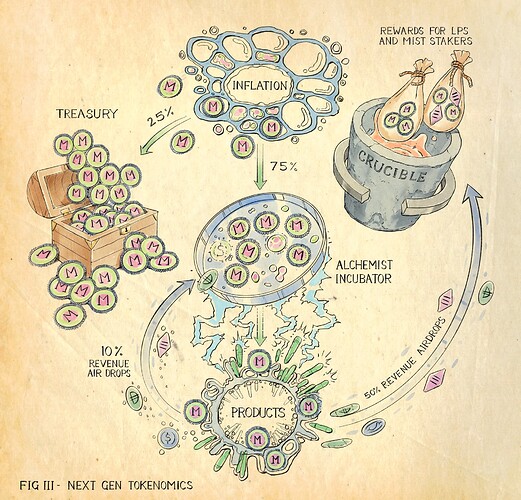

The details of the new tokenomics proposal are as follows:

-

Redirect the MIST inflation currently sent to existing MIST-WETH LP stakers to instead go to the Alchemist Multisig for the sole purpose of funding and incubating new products.

-

Redirect up to a maximum of half of the revenue airdrop going to MIST-WETH LPs Rewards to go to single-sided MIST stakers in a new rewards program called “Community Harvest Alchemist Distribution (CHAD)” aka “CHAD Stakers Rewards”. The proportion of revenue redirected is variable and will be determined by the proportion of single-sided MIST being staked relative to current free-floating MIST supply. Rename the Aludel Rewards for MIST-WETH LPs as “CHAD LPs Rewards”.

-

Revenue airdrops for both CHAD rewards programs would be airdropped in the currencies that they are earned in, rather than MIST, in order to avoid adding unnecessary selling pressure to MIST. Historically these native tokens would include USDC, ETH, WETH.

-

To be eligible for CHAD Stakers Rewards, one’s tokens need to be locked in the CHAD program for a minimum period of 90 days. Withdrawing a stake prematurely will result in the forfeiture of any rewards earned.

-

Before revenue airdrops are distributed, analysis of the free-floating MIST supply will be undertaken and distributed according to the threshold levels laid out in the table below. Establishing which threshold has been reached will be performed on a monthly basis. The Alchemist Council will monitor participation in the rewards programs and reserves the right to make adjustments to the thresholds and splits within it in order to promote a healthy balance between MIST-WETH LPs and single-sided MIST stakers.

-

Participants in the CHAD Rewards for LPs and MIST stakers will be able to partake in governance proportionally based on the share of revenue airdrops they are earning under the most recently achieved thresholds.

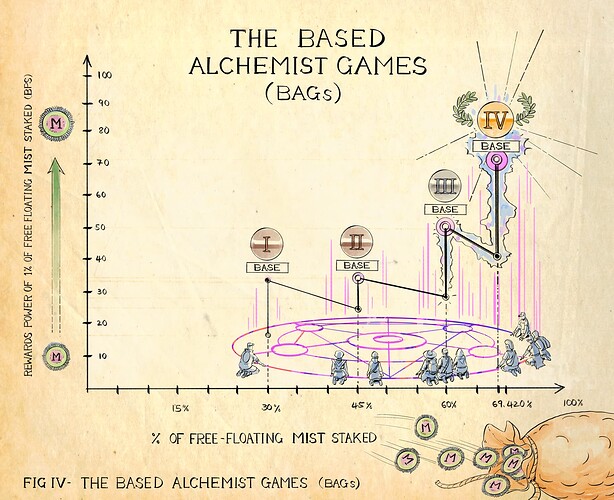

The following are the proposed single-sided staking levels to unlock the revenue redirection from CHAD Rewards for LPs to CHAD Stakers Rewards. This can be thought of as a coordination game between single-side MIST stakers. The Based Alchemist Games (BAGs) have four levels that lead up to the climax of the game (ie. max rewards per % of free-floating MIST staked).

| BAG Levels | % of free-floating MIST staked in Crucibles | % of revenue airdropped to CHAD LPs | % of revenue airdropped to CHAD Stakers |

|---|---|---|---|

| Default | 0 - 29.99 | 47.5 | 2.5 |

| 1st Base | 30 - 44.99 | 45 | 5 |

| 2nd Base | 45 - 59.99 | 42.5 | 7.5 |

| 3rd Base | 60 - 69.419 | 35 | 15 |

| 4th Base | > 69.420 | 25 | 25 |

The breakdown above outlines the proposed allocation of the 50% revenue airdrops and is dependent on the amount of free floating MIST. Free floating MIST excludes MIST locked up in LP, Crucible rewards pool, the treasury, the multisig, and vesting contracts.

Next Gen Tokenomics Benefits

The proposed tokenomics changes will:

-

Greatly diversify the group of stakeholders benefiting from revenue airdrops.

-

Incentivise the locking of MIST, reduce the free-floating supply of MIST, decrease MIST sell pressure, and increase MIST accumulation further applifying the value accrued to MIST.

-

Foster collaboration within the community as it tries to hit each of the staked MIST levels, unlocking more value for the MIST stakers.

-

Encourage LP providers to periodically unwind staked positions in order to participate in the Based Alchemist Games (BAGs), providing better opportunities for new entrants into LP and rewards program positions.

Alchechad Rewards Program

We believe vested MIST has the potential to strongly align Alchemist contributors with our community’s long term success. As a way to further encourage community members to become active Alchemist contributors we’re proposing two additional Crucible rewards programs, Alchechad Rewards for LPs and Alchechad Rewards for MIST stakers, which would distribute 5% of inflation to all LP providers and single-sided stakers that lock their MIST for 12 months (2.5% to LPs and 2.5% to single-sided stakers). An early exit would result in forfeiture of any accrued MIST token rewards. The full details and timing of these rewards programs are still to be determined, but we plan on pushing them through after the new tokenomics initiatives outlined above go live.

Definitions

MIST - The ERC-20 token used to align the participants of the Alchemist ecosystem.

Inflation - A property of the MIST token where its supply increases by 1% every 14 days.

Circulating supply - The amount of a token’s supply that is available for trading. Currently for the MIST token the total supply is the same as the circulating supply and the token is inflated by 1% of its total supply every 14 days.

MIST-WETH LP - The MIST-WETH liquidity pool enables the decentralised exchange between WETH and MIST pair. A large liquidity pool is critical for a healthy ecosystem as it enables participants to easily exchange ETH for MIST or vice versa. Currently about 30% of the MIST supply is locked up within the MIST-WETH LP and the LP is contributed to by around ~7K wallets.

Free-floating MIST - MIST not locked up in LP, the Crucible rewards pool, the treasury, the multisig, or vesting contracts. Currently that’s about 50% of MIST and it is held across ~11K wallets.

Crucible - A smart contract wallet built within Alchemist. One of its features is to enable its owner to prove they hold (stake) a particular ERC-20 asset in Crucible and subscribe to be rewarded by a third party for holding that asset. Reward subscriptions are non-custodial, so the assets never need to leave the user’s wallet when subscribing to new rewards programs.

Product revenues - Revenues resulting from products within the Alchemist ecosystem. A community vote was passed to direct 50% of core product revenues (the first 3 fully incubated products: Crucible, mistX, Copper) while they’re incubated to be airdropped within the Aludel rewards program.

Aludel rewards program (soon to be renamed to CHAD LPs Rewards) - The current Aludel rewards program incentivizes Uniswap V2 MIST-WETH liquidity providers to stake their LP tokens in Crucible with 50% of MIST inflation and 50% of all Alchemist product revenues in form of a MIST buyback. The program has a maximum multiplier of 10x that can be achieved from remaining subscribed in the program more than 60 days.

Community Harvest Alchemist Distribution (CHAD) for MIST Stakers - aka CHAD Stakers Rewards. The Alchemist rewards program introduced to incentivize single-sided MIST stakers and reflect the proposed changes to Alchemist tokenomics.

MIST-WETH LP staking - Holding the MIST-WETH LP ERC-20 token in Crucible that represents the fact that one deposited liquidity into the Uniswap V2 MIST-WETH liquidity pool. Such tokens are automatically issued by uniswap into one’s wallet upon providing liquidity to the MIST-WETH pool.

Single-side MIST staking - Subscribing to CHAD Stakers Rewards via Crucible.

Product - An article or substance that is manufactured or refined with the goal in mind to accrue value to the MIST token.

Alchemist Council - Community elected governing body tasked with managing the effective distribution of MIST inflation.

Alchemist Seniors - Builders and community members that took on a more active role in helping manage the day to day activities within Alchemist.

Polling Period

The informal forum poll begins now and will end on July 13th at midnight. Assuming in favor, this vote will go to Snapshot.

- For: Create CHAD rewards programs for LPs and single-sided MIST stakers to be funded by product revenue airdrops in native tokens; redirect MIST Inflation from rewards programs towards the Alchemist Incubator

- Against: Keep the current Aludel rewards program and MIST inflation distribution as it is

- Abstain